The US reciprocal‑tariff policy, also referred to as ‘Liberation Day tariffs’ by President Trump’s administration, has introduced significant uncertainty into the cocoa market, CocoaRadar reports

By raising import costs for raw and processed cocoa, it squeezes the incomes of farmers in West Africa and other producing regions, encourages US buyers to shift sourcing to alternative countries, and threatens to exacerbate poverty, deforestation and political tensions.

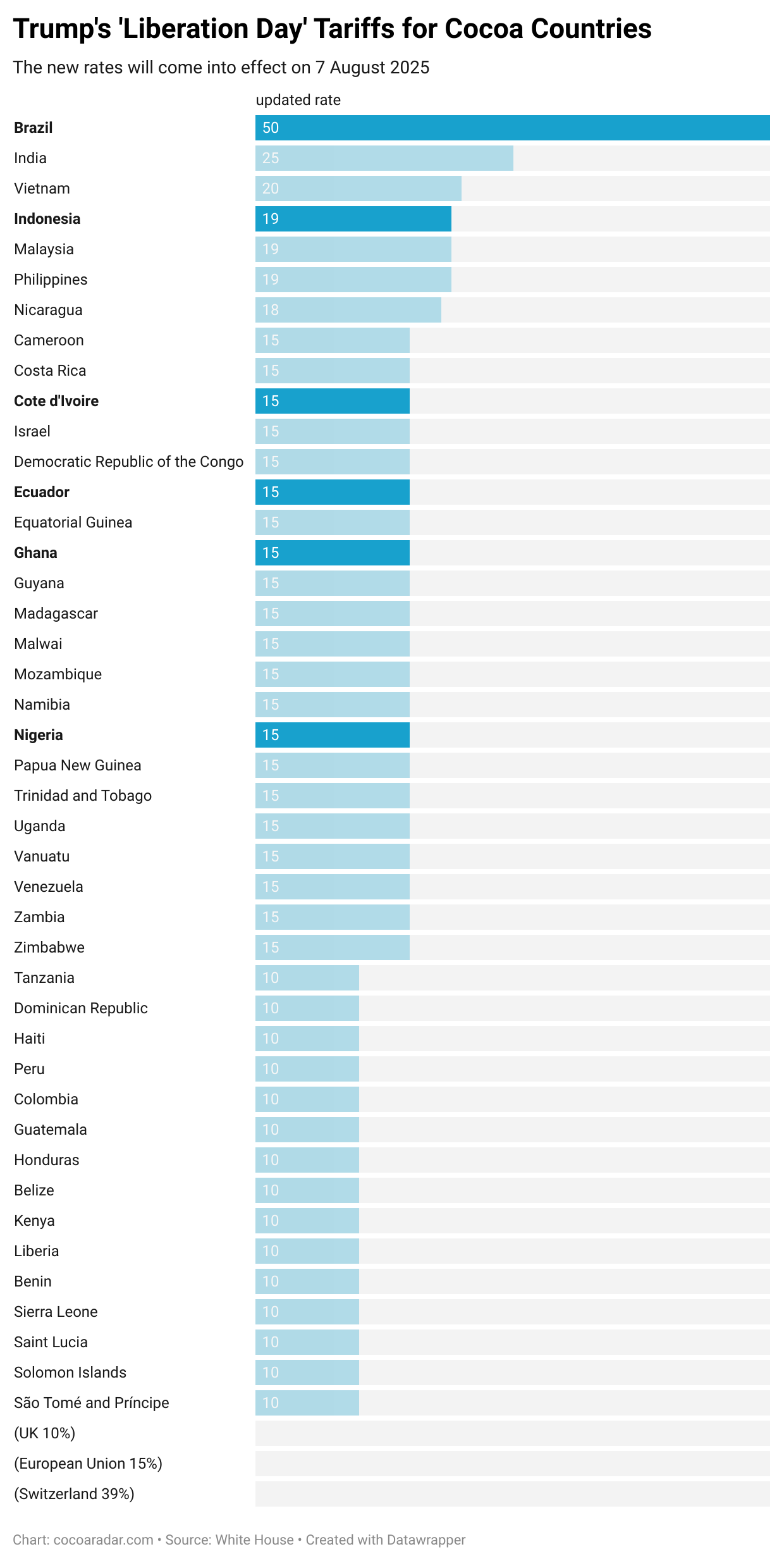

Announced on Friday, 1 August, with implementation from this Thursday (7 August), Côte d’Ivoire, the world’s largest cocoa producer, was facing a 21% levy on imports (including cocoa). Still, that figure looks to be adjusted to 15% and 10% on Ghana (the second largest cocoa-growing country).

Baseline Tax

The Trump administration has also imposed a baseline 10% tax on most other cocoa-exporting nations, all countries that lack domestic cocoa production.

Swiss exporters, including chocolatiers, were also left reeling when the country was slapped with some of the highest tariffs of any US trading partner, dwarfing EU rates. The unexpected escalation to 39% jeopardises export volumes, risks economic slowdown, and has triggered urgent diplomatic and trade negotiations between the two countries aimed at securing exemptions or mitigating the impact.

These new tariffs have sharply increased input costs for American chocolate producers, while Canada and Mexico benefit from tariff-free treatment under USMCA - even when using West African cocoa - giving them a clear cost advantage in the US market.

Futures prices for cocoa fell sharply at the end of last week, indicating that traders expect reduced US demand and altered trade flows. Analysts expect North American buyers to seek processing routes through countries like Canada or Mexico, which face no tariffs under the USMCA, and to source more cocoa from countries not targeted by high US tariffs. CocoaRadar understands that such shifts could reduce direct purchases from African producers.

How Cocoa‑Growing Countries Are Affected

Côte d’Ivoire & Ghana

Farmers in West Africa already face weather-related challenges and swollen shoot disease; the imposition of tariffs exacerbates existing market instability. Local producers express concerns that any US tax on cocoa would further undermine already fragile incomes and supply reliability.

With the 2025-26 main harvest season just weeks away, the Côte d’Ivoire-Ghana Cocoa Initiative (CIGCI) is working to influence price-setting mechanisms to enhance farmer revenues in the face of volatility and unfair trade barriers.

Latin America

Countries like Brazil are threatened with a whopping 50% new US tariffs, especially amid diplomatic tensions, though Cocoaradar understands that coffee and cocoa are under review for potential exemptions.

Market & Industry Consequences

Cocoa prices have more than doubled over the past two years, driven by disease, climate change in West Africa, and speculative trading, which has further increased export revenues but also heightened global price risk.

As previously reported by this website, US chocolate manufacturers, including Hershey, have projected tariff-related costs of $100–180 million per year, prompting them to raise retail prices, shrink packaging (shrinkflation), and even relocate production to Mexico or Canada to sidestep tariffs.

According to Howard Lutnick, the United States Secretary of Commerce, coffee and cocoa may be exempt from tariffs in new trade agreements; however, this has not yet been implemented for countries without existing deals, such as Ghana or Côte d’Ivoire.

Tariff Spillover: Implications for the European Union

European Commission President Ursula von der Leyen and President Trump announced that a EU-US trade agreement had been reached hours before the August 1 deadline, avoiding the 30% tariffs threatened by Trump months earlier. That figure for general imports is now 15%.

In essence, while the EU currently benefits from tariff-free access for cocoa-based products into the US under existing WTO frameworks and bilateral arrangements, this dynamic may intensify supply chain consolidation in Europe and reinforce West Africa’s role as a raw material supplier, rather than becoming a serious producer of finished chocolate exports.

Still, the indirect impact is real:

- EU chocolate exports to the US have become increasingly competitive, particularly from countries such as Belgium, Germany, and France, which already dominate the premium chocolate market. This provides an export edge over African-origin cocoa-based products processed domestically in Ghana or Côte d’Ivoire.

- European manufacturers sourcing West African cocoa and reprocessing it locally before exporting to the US can avoid direct tariffs, highlighting a loophole that favours value-added cocoa processing in Europe over at origin.

- However, concerns remain that future US trade policy - especially under a second Trump administration - could include retaliatory tariffs on processed chocolate or EU-based brands, depending on broader geopolitical tensions.

US Tariffs Targeting Switzerland

Current Tariff Rates and Scope:

- An executive order issued by President Trump set a 39% tariff on Swiss imports to the US, effective 7 August, 2025, one of the steepest in his global trade reset.

- This exceeds earlier announcements (31%) and significantly surpasses the 15% tariff imposed on EU exports to the US.

Impact on the Swiss Chocolate Industry:

- Swiss chocolate and related products face the full weight of the tariff. Small- and mid-sized chocolatiers project dramatic cost increases, effectively approaching 50% when currency conversion is factored in.

- The Association of Swiss Chocolate Manufacturers forecasts steep declines in US sales and warns of lost customers and revenue.

So, What’s Next?

Some cocoa producers view the tariffs as punitive. CocoaRadar notes that targeted countries could retaliate or pivot toward alternative partners like China or the EU. Côte d’Ivoire’s government stated that approximately 4% of its trade is with the United States and that the tariffs could prompt it to seek alternative markets for its cocoa. Nigeria’s inclusion in the US tariff regime and the threat of further penalties are linked to broader geopolitical disputes.

Broader Implications & Outlook

- Pressure for Exemptions: US industry groups and legislators are lobbying for cocoa to be excluded from tariffs, citing that cocoa cannot be grown domestically on scale.

- Market Realignment: A decisive shift toward Canada and Mexico for US chocolate supply chains, with some American brands planning long-term relocation for cost efficiency.

- Developing Countries’ Role: Governments in major cocoa‑producing countries may diversify their export markets or strengthen price-setting coalitions such as the CIGCI to buffer against trade policy shocks.

- Potential Trade Deals: Future agreements, particularly with the EU, Indonesia, and others, may allow for zero-tariff treatment of cocoa and similar commodities - although implementation timelines remain uncertain.