In short, analysts anticipate that cocoa prices will remain volatile in the near term due to ongoing supply challenges and market uncertainties. However, improved weather conditions and increased investments in cocoa farming could stabilize prices in the longer term.

These figures indicate a slight increase from the previous day’s prices, reflecting ongoing market dynamics.

Recent Price Movements

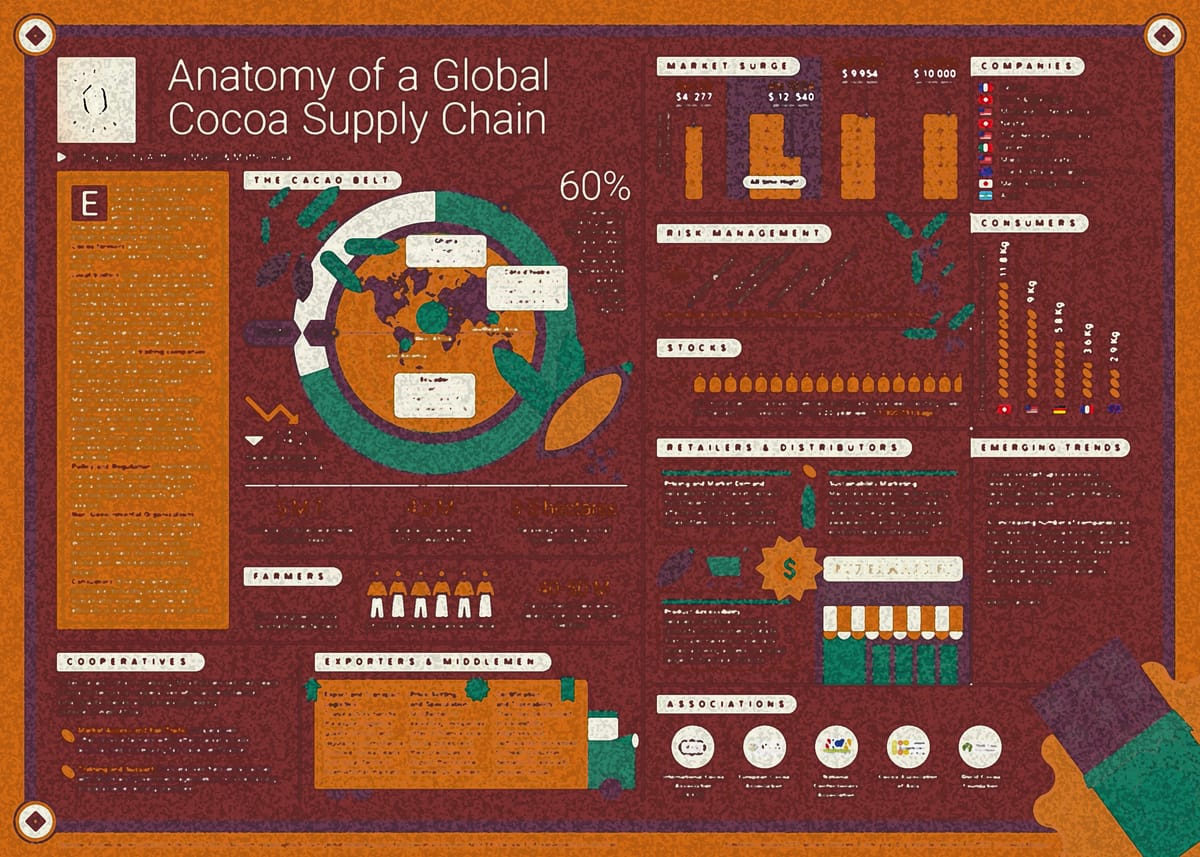

Cocoa prices have experienced significant volatility in 2025. After reaching an all-time high of approximately $12,931 per metric ton in late 2024, prices have declined by over 30% year-on-year, falling below $8,000 per ton. This drop is attributed to improved weather conditions in West Africa and increased exports from countries like Nigeria, which have alleviated some supply concerns.

Supply & Demand Dynamics

- 2023-24 Deficit: The International Cocoa Organization (ICCO) reported a significant global cocoa deficit of 441,000 metric tons for the 2023-24 season, marking the largest shortfall in over 60 years.

- 2024-25 Surplus Forecast: For the 2024-25 season, the ICCO projects a global cocoa surplus of 142,000 metric tons, anticipating a 7.8% year-on-year increase in production to 4.84 million metric tons.

Although this depends on the quality of the mid-crop in West Africa. Reports indicate that about 5% to 6% of the mid-crop cocoa in Cote d'Ivoire is of poor quality, compared to 1% during the main crop, affecting overall supply.

According to Rabobank, the poor quality of the Cote d'Ivoire's mid-crop is tied in part to late-arriving rain in the region that limited crop growth. The mid-crop is the smaller of two annual cocoa harvests, which typically starts in April. The average estimate for this year's Cote d'Ivoire mid-crop is 400,000 MT, down -9% from last year's 440,000 MT.

- Ghana’s Production Challenges: Ghana, the world’s second-largest cocoa producer, has faced production setbacks due to plant diseases and adverse weather, reducing its 2024-25 cocoa harvest forecast to 617,500 metric tons.

Impact on the Chocolate Industry

The surge in cocoa prices has pressured chocolate manufacturers:

- Price Adjustments: Major companies like Hershey and Mondelēz International have reported decreased sales and are adjusting their product offerings in response to high cocoa costs.

- Price Increases: Companies like Lindt have raised product prices to offset higher raw material costs.

- Product Reformulation: Some manufacturers are reducing cocoa content or using alternative ingredients to manage costs.

- Consumer Behaviour: Higher chocolate prices may lead consumers to seek more affordable alternatives or reduce consumption.

Future Outlook

Analysts have mixed views on the future of cocoa prices:

- Bullish Perspective: Some forecasts suggest that cocoa prices could remain elevated, potentially reaching just under $9,000 per ton in 2025, due to ongoing supply challenges and steady demand.

- Bearish Perspective: Others anticipate that improved weather conditions and increased production could lead to a stabilization or further decline in prices.

- sources: nasdaq/capital.com/ICCO/New York Post/Reuters/barchart.com