Cocoa has emerged as the best-performing commodity of 2024, with prices nearly tripling over the past 12 months. Despite expectations of a modest global surplus of 142,000 tons in the 2024-25 season, according to the International Cocoa Organization (ICCO), the industry continues to grapple with structural production issues that threaten long-term supply stability and profitability.

Production Challenges in West Africa

West Africa, responsible for over 70% of global cocoa output, faces severe production difficulties. Chronic underinvestment, climate change, and the spread of plant diseases such as black pod and swollen shoot have impacted over 80,000 hectares of cocoa farms in Ghana, the world’s second-largest producer. These diseases have reportedly affected 65% of West African cocoa farms, cutting yields by as much as 50% in some areas.

Experts warn that cocoa production in major suppliers like Côte d’Ivoire and Ghana has plateaued, creating uncertainty about future supply. Industry leaders are calling for urgent investments in research, forecasting, and collaborative solutions to secure the future of the cocoa sector.

Impact on Chocolate Companies

The supply crunch has triggered significant financial consequences across the chocolate industry. Barry Callebaut, the world’s largest cocoa supplier, is reporting volume declines, while major brands like Hershey are facing earnings downgrades due to soaring cocoa prices. Mondelez International, with a diversified product portfolio, is expected to weather the storm more effectively.

Further complicating the market landscape, the potential introduction of U.S. tariffs on chocolate imports from Canada and Mexico, alongside growing consumer frustration over ‘shrinkflation,’ is causing industry-wide concern.

Industry Experts Sound the Alarm

Speaking at the Chocoa Amsterdam Sustainable Cocoa Conference last month, commodity trader and consultant Pam Thornton noted that many industry players had previously underestimated the severity of the crisis. “Even as late as last autumn, many believed this was a temporary issue,” Thornton said. “But the era of cheap cocoa that the industry has relied on for years is over.”

The crisis has exposed vulnerabilities within the industry, particularly for West African farmers, who remain largely excluded from benefiting from record-high cocoa prices due to forward-selling agreements set by government regulators.

A Call for Sustainable Solutions

Cocoa is a delicate crop requiring careful management. Industry leaders are now emphasizing the need for sustainable farming practices, scientific research, and technological advancements to safeguard the future of cocoa production.

Thornton has also called for the need to improve forecasting tools and make this information more widely available to the industry, rather than keeping it within a small group of private companies.

“We need the private forecasters to continue, and thankfully, they exist. However, it would be helpful for the market as a whole, especially origins, if more information could be made available, perhaps through the auspices of ICCO.

“Forecasts could be anonymized, shared and either averaged, or perhaps used to compile a range, and then disseminated widely … as right now most of the producing countries have no idea what is going on outside their borders.

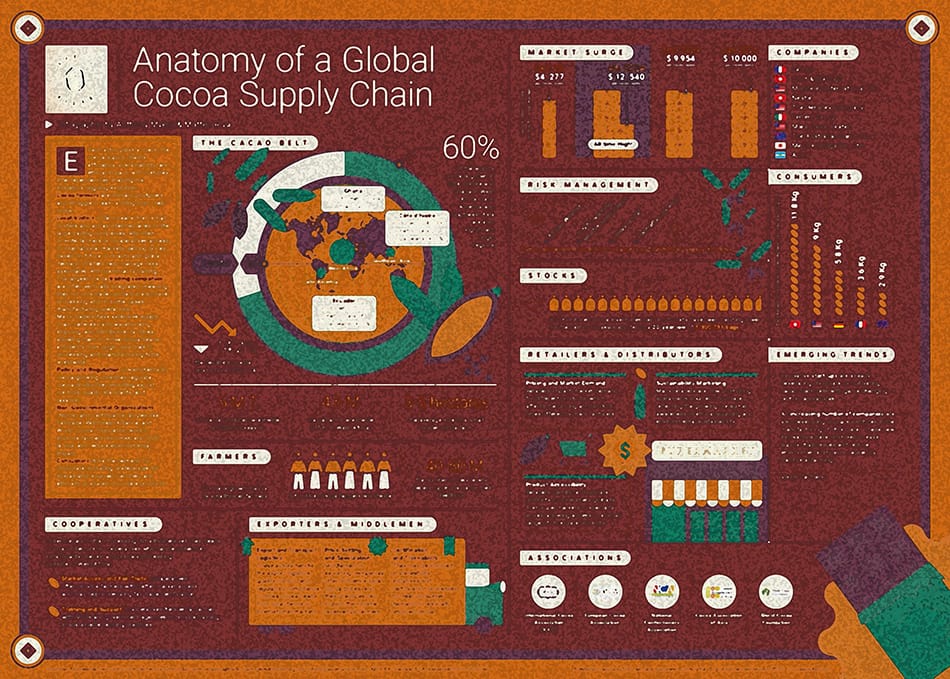

Anatomy of a Global Cocoa Supply Chain

To address the growing complexity of the cocoa supply chain, cocoaradar.com has released an informative infographic, ‘Anatomy of a Global Cocoa Supply Chain,’ and a 10-page Spotlight Paper detailing the industry’s intricate supply chain dynamics—from smallholder farms to consumer products.

Editor Anthony Myers highlighted the value of these resources: “In a world of complex supply chains, this is a valuable tool for the chocolate industry and anyone interested in how cocoa is grown, produced, and sold. Special thanks to our project vision partners, Picterra, Chocoa, African Cocoa Marketplace, for their support in launching this important initiative.”

The Spotlight Paper and infographic are available for download here.

cocoaradar.com is:

- Official Media Partner - World Cocoa Foundation Partnership Meeting in São Paulo, Brazil, 19-20 March 2025.

- Official Media Partner - Amsterdam Sustainable Cocoa Conference, Chocoa, 4-9 February 2025.

- 'From Our Desk. To Yours'

- Sign-up here for free and upgrade to an annual plan with a 35% discount