In his opening speech at the 2025 World Cocoa Foundation Meeting, Chris Vincent said the role of consumers in the cocoa supply chain and the challenges they face with rising living costs will be a key topic for the cocoa industry in the months ahead

With global cocoa prices fluctuating from $6,000 to $8,000 per tonne, impacting smallholder farmers, particularly in Ghana and Cote d'Ivoire, it was left to the following panel of experts to unpick world cocoa economics highlighting the role of business models, governance, and shifting consumer preferences.

Moderator of the cocoa economics session, Eduardo Bastos, IEAG (ABAG) Executive Director, explained that the industry is at a crossroads, noting the unique challenges of cocoa production, such as long growth cycles of the pods and the need for pre-competitive efforts for efficiency.

He outlined three main discussion points: prices, costs, and the impact of climate change, including aging trees, consumer patterns, diseases, and future uncertainties. He called on the panelists to provide a future outlook for the cocoa sector, considering the uncertainties ahead.

Supply and demand dynamics

Michel Arrion, the International Cocoa Organization (ICCO) Executive Director, said discussions should focus on the cocoa market's supply and demand dynamics. Production peaked at 5.2 million tonnes in 2021, while grindings reached 5.1 million tonnes in 2023. A significant drop in production in 2024 led to an excess of 140,000 tonnes in grindings.

The forecast for 2025 predicts 4.8 million tonnes of production and 4.6 million tonnes of grindings. “Price fluctuations were noted,” he said, “with real prices far from historical highs.”

Factors influencing production include weather, pest management, and trade finance challenges. Regarding consumer spending, he highlighted the importance of disposable income and market access, particularly in Asia, with its burgeoning wealthy middle-class population.

Arrion also highlighted the impact of non-tariff barriers on smallholder and large-scale farming models.

Economic, environmental, and social pillars

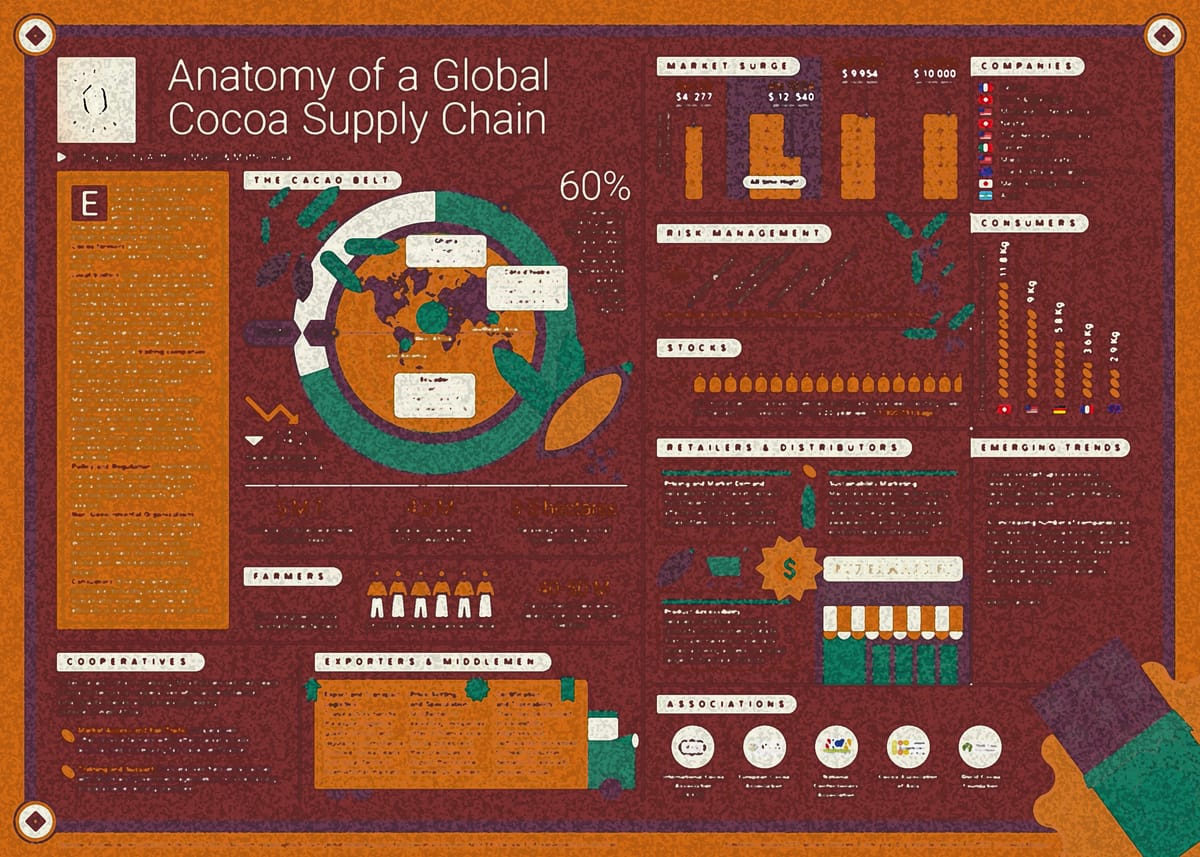

Alex Assanvo, Initiative Cacao Côte d’Ivoire-Ghana (ICCIG), Executive Secretary, emphasized balancing economic, environmental, and social pillars. He highlighted the historical context of Ghana's initiative to reduce dependence on it and neighbour Cote d’Ivoire for 60% of global cocoa production.

Assanvo underscored the inadequacy of current market prices, which are around $8,000, compared to the $10,000-$12,000 demanded by traders. The need for sustainable production and pricing to incentivize farmers was stressed, noting that consumption levels do not match Ghana's cocoa production.

“The sector needs to rethink,” he said. The market has not been set up to deliver social or economic benefits to farmers, and we have to come together with a solution. We need to invest more and more in research and science. We need data. Sustainability is about three pillars: economic, environmental, and social. So if we are not connecting the three, it's not possible to achieve anything.”

He concluded with a call for collaborative investment in research and transparency to achieve sustainable market practices.

Business sustainability

Santiago Gowland, Rainforest Alliance's chief Executive Officer, said the NGO has been working 40 years to certify sustainable agricultural practices, covering over 51% of global cocoa production across 62 countries and 6,700 companies.

The organization emphasizes the importance of aligning business sustainability with the interests of people and nature, moving towards a resilient and innovative era.

He said they are leveraging the Rainforest Alliance's training capacity to develop entrepreneurial income, agroforestry, and pesticide/fertilizer management for farmers.

Gowland explained that the Rainforest Alliance is also developing a new, more straightforward data set and a regenerative agriculture standard, aiming to shift from minimizing harm to maximizing positive impacts.

“The Rainforest Alliance is working on specialized carbon standards, livelihood standards, and landscape and community impact projects, such as training in Ghana,” he informed the meeting.

He said The Rainforest Alliance is committed to the need for pre-competitive collaboration to improve efficiency and focus competition “where it matters most.”

Cocoa futures

Mark Taylor Hershey Trading GmbH, Strategic Sourcing Director of Commodities, highlighted the company’s recent issues with the cocoa exchange, which he claimed is distorted and expensive for small players, potentially leading to long-term high prices and reduced consumption, with future surpluses a concern.

“It's not working if you're a large player, like Hershey or Mars, or it's very difficult to manage your risk on the exchange. If you're a small player, these exchanges become extremely expensive to use.”

He noted a quadrupling of cocoa prices over two and a half years, increasing industry costs by $40 billion.

Production has risen, with exports from Ghana and Ecuador increasing by 50% between October and January, adding half a million tons of cocoa. Despite this, prices remain high, reaching $10,000 per tonne.

Consumption has decreased, with chocolate confectionery down 2-3% last year. Tayor said that the message of high prices goes through to the consumer. It affects consumption and could go down by 3-5% in 2025.

Taylor mentioned that when he visited a supermarket in Sao Paolo earlier this week, he was surprised to see, for the first time in his life, a security label on a 100 gramme bar of chocolate.

" That really stood out to me, because it just shows how expensive chocolate has become," he said. He highlighted that with cocoa now more popular than copper traders are also taking extra security measures when transporting cocoa beans from the warehouses in origin countries to the ports.

Global Cocoa Survival Initiative

Pam Thornton, Commodity Trader at Nightingale Investment Management Limited, said part of the problem is that the industry still doesn’t understand the basics of cocoa as a crop and claimed research is fragmented, calling for a global - cocoa survival initiative jointly sponsored by WCF and ICCO to mobilize funding for global Agscience Centres of Cocoa Excellence.

Once again, she highlighted the risks and complacency in the cocoa industry, particularly in West Africa, where production issues and low farmer incomes persist despite abundant supply in the past

She noted the significant price increase in 2023, with prices peaking at $12,000 per ton and currently around $7,000-$8,000.

Thornton called for “practical sustainability, comprehensive research, and improved farm management practices.”

She urged the industry to adopt a more collaborative effort involving the private sector, governments, and NGOs to address issues like pests and diseases and yield improvement, citing the success of CCN-51 clone in Latin America, which has increased farm yields and is more resistant to crop disease.

She warned that the potential for another production crisis underscores the urgency if immediate action isn't taken.

Check out all our coverage surrounding the WCF Partnership Meeting

cocoaradar.com is:

- Official Media Partner - World Cocoa Foundation Partnership Meeting in São Paulo, Brazil, 19-20 March 2025.

- 'From Our Desk. To Yours'

- Sign-up here for free and upgrade to an annual plan with a 35% discount