As Ghana approaches a pivotal democratic journey, the excitement surrounding the upcoming government transition in January 2025 is palpable, especially for the country’s cocoa sector, writes Anthony Aidoo

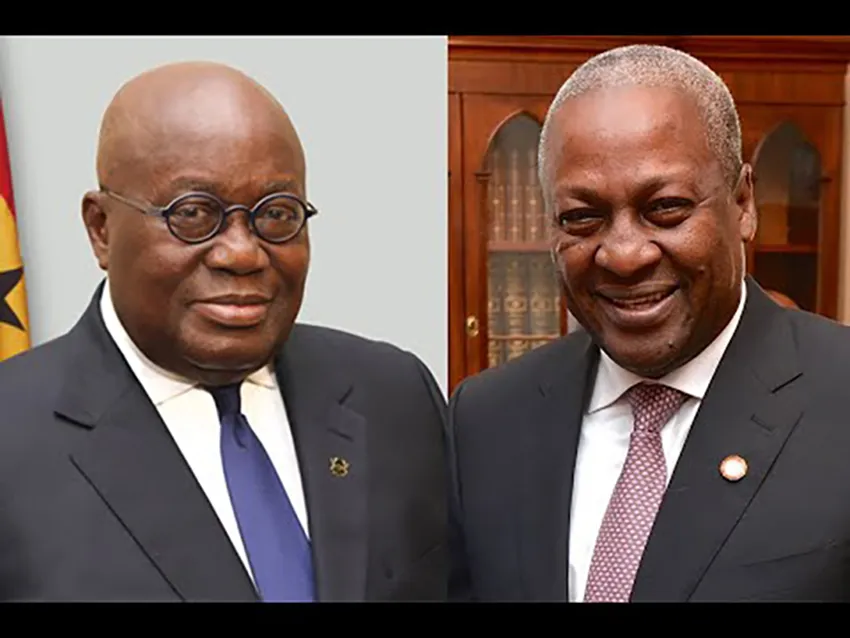

With elections set for 7 December 2024, all eyes are on this critical presidential and parliamentary race that follows the eight-year tenure of HE Nana Addo Akufo-Addo, the country's incumbent president.

The stakes are high in the closing stages of the election race as the nation prepares for possible leadership changes.

The ruling party's desire for continuity is embodied in the current vice president, a respected leader with a strong background in economic management and experience as the former deputy governor of Ghana’s central bank.

As he heads the current regime's economic management committee, Ghanaians have expressed growing concern that the economic developments seen since January 2017 have not materialised as promised before the December 2016 elections.

Yet, the future of Ghana’s cocoa industry—a vital component of the national economy—is uncertain, and this uncertainty may significantly influence the electoral outcome.

The ruling party proudly highlights its achievements in educational reform, particularly the landmark initiative of free senior high school education. While it has undeniably impacted the nation, absorbing 80% of oil revenues, there are rising concerns about its implications for agricultural sectors, specifically cocoa.

Cocoa industry at a crossroads

Looking ahead, the Ghana Cocoa sector finds itself at a crossroads as the Ghana Cocoa Board (Cocobod) navigates recent government interventions. This traditionally independent body, overseeing everything from cultivation to marketing, faces a new challenge with its reclassification under the Ministry of Agriculture. This change prompts critical questions about its ability to make decisions favourable to the industry and its stakeholders.

Historically, Cocobod has flourished under various administrations, demonstrating resilience in sustaining one of the nation’s vital agricultural exports. However, speculation about these recent developments raises concerns about access to crucial syndicated loans needed for the cocoa trade. The proposed strategic realignment could have far-reaching implications for the industry’s trajectory. Under this regime, the regulator is heavily indebted to LBCs and its creditors.

As the elections approach, the fate of Ghana’s cocoa industry teeters on a knife's edge. There is an undeniable possibility that the next government could either revitalise this essential sector or allow it to falter amid competing priorities like educational initiatives and infrastructural development. The choices made in the coming days are bound to be instrumental in determining the livelihoods of cocoa farmers and the country’s broader economic landscape.

The challenges facing the cocoa industry are significant. For the first time in 20 years, the cocoa regulator has opted not to pursue the usual syndicated loans that bolster cocoa trade. This decision may resonate through the financial structures of many licensed buying companies (LBCs) since syndicated loans contribute about 60% of the total capital structure of most LBCs, especially the locally based ones. They also help stabilise the country’s currency against other major international trading currencies like the US dollar.

Meanwhile, bondholders, including pensioners who have invested in Cocobod through local bonds, find themselves at a pivotal juncture as they grapple with reduced earnings amid a government-led debt restructuring initiative. Additionally, Cocobod has struggled to fully compensate LBCs for cocoa delivered in the past two years, heightening concerns over operational viability.

This shifting landscape underscores the urgent need for strategic solutions to steer the cocoa industry towards a sustainable future. The next few days will be crucial as stakeholders prepare to navigate these uncertain waters, seeking pathways to recovery and growth.

The main opposition party’s perspective

The National Democratic Congress (NDC), led by former President HE John Dramani Mahama, stands prepared to offer a contrasting vision for Ghana’s future. Historically, during its governance, the NDC fostered an environment conducive to a thriving cocoa industry despite broader economic challenges.

The opposition's previous approach emphasized minimizing hurdles to funding cocoa, allowing the sector to excel despite difficulties in other areas. Cocobod's autonomy and effectiveness during this era reaffirmed what could be achieved once again. Generally, most industry players have touted the main opposition party as a ‘good cocoa trader.’

Expectations of Ghanaians

As Ghanaians reflect on past leadership and eagerly anticipate the upcoming election, there is a collective hope that the next government will inject new vigour into the cocoa industry, ensuring it receives the necessary support for a resurgence. The decisions made shortly hold the potential to shape the outcomes for cocoa farmers and the national economy for years to come.

The future of Cocobod

With anticipation building ahead of the elections, many Ghanaians express concern that the current ruling party's re-election could bring about even more significant challenges for the industry. If the existing management team at Cocobod continues in its role, fear looms over the possibility of a weakened cocoa sector.

The current government's decisions to realign Cocobod under the Ministry of Agriculture have done more harm to the sector than the purpose intended despite a two-time price review during the 2023-2024 and the recent 2024-2025 seasons. Therefore, Ghanaians and industry players expect a possible restoration of the regulator's autonomy when the opposition party is voted back to power.

We are all anticipating the outcome of Saturday’s election, which will have a meaningful impact on the national cocoa sector. Ghana is currently the second-largest cocoa producer globally, so the vote could have implications beyond its borders.

On this note, we wish the Ghanaian people a peaceful electioneering process and hope whoever gets into power will acknowledge the country's cocoa community and support it accordingly.

- Anthony Aidoo is steering committee chair, FAO-World Food Forum Ghana, and board chair-communities forestry and social development. He lives in Winneba, Central Region, Ghana.