As we previously reported, on 14 November, the European Parliament voted to delay the implementation of the European Deforestation Regulation (EUDR) by 12 months.

This delay, proposed by the European Commission and previously agreed upon by the European Council, allows large enterprises until 30 December 2025 to comply with the law, while small and medium enterprises have until 30 June 2026.

'No risk' amendment

An amendment to introduce a new category of 'no-risk' countries was also proposed in the European Parliament, which was then passed by MEPs.

The 'no-risk'" amendment to the EUDR introduces the possibility of significant loopholes that could weaken the regulation's intent to prevent deforestation-linked commodities from entering the EU market. By reducing due diligence requirements for specific countries, the amendment may inadvertently facilitate the entry of products associated with deforestation, thereby compromising the EUDR's environmental objectives.

According to UK legal practice Osborne Clarke, the full EUDR proposal must be returned to the Commission/Council for further negotiation. However, the Council is expected to reject the Parliament's amendments and calls for the EUDR to proceed as planned, with only a year delay allowed.

Risk of 'commodity laundering'

While the year-long extension has now been agreed upon across the board and is highly likely to come into effect at the end of this year, if the no-risk amendment is also agreed upon, one potential loophole is the 'risk of commodity laundering,' which could allow products linked to deforestation in high-risk countries to be routed through 'no-risk' countries, effectively bypassing the regulation's safeguards.

Black market polygons

Another widespread concern is that delays could lead to a flourishing black market in polygon mapping.

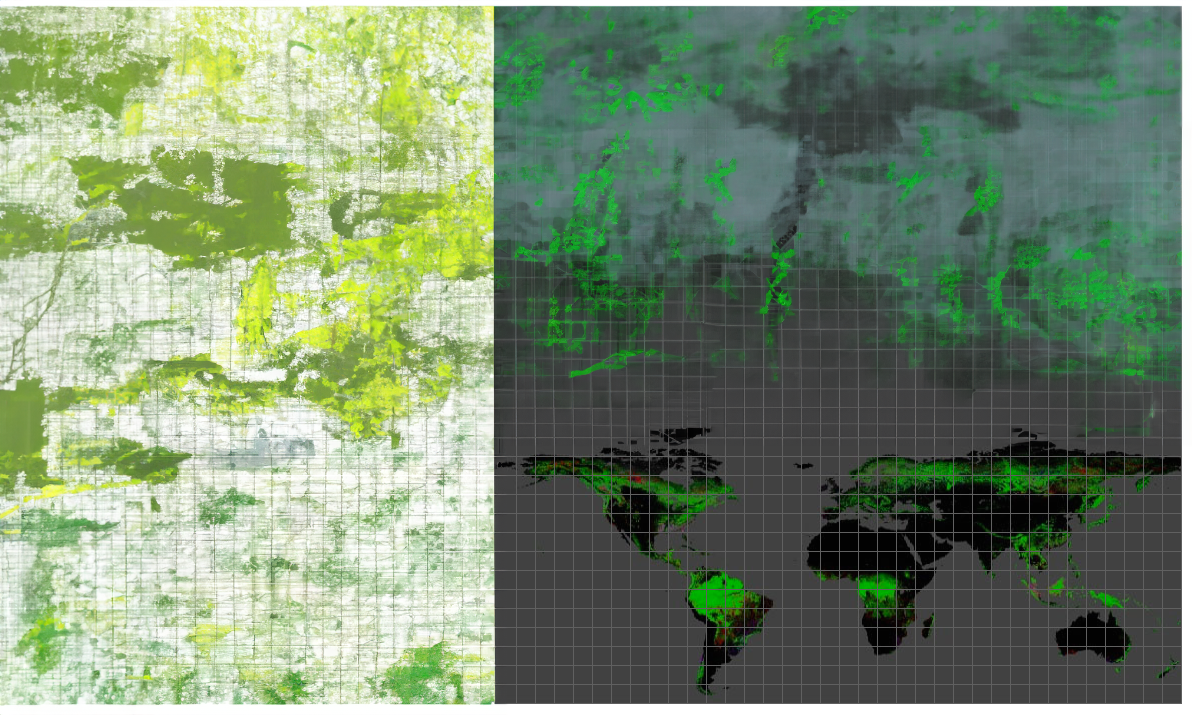

Mapping cocoa farms using polygons is a modern approach to enhancing transparency and accountability in the cocoa supply chain. This method involves geospatial technology to precisely delineate the boundaries of individual farms and analyze their location and environmental impact.

Conservative estimates suggest that the going rate for polygons is approximately $12,000, and cocoaradar.com is aware that some companies offer discounts of up to 50%.

Ferdi Van Heerden, founder of COOKO, a first-mile cocoa and traceability company that mainly operates in West Africa, says there is a certain amount of chaos and confusion in the cocoa industry. He said an investor told him: "Cocoa does not have a traceability problem; it is a deforestation problem."

Van Heerden told cocoaradar.com. "This misplaced focus on the information layer has created a new set of perverse incentives … a new black market for farm polygons. If 'deforestation-free' polygons are the tokens needed for market entry, this will be provided."

He said it's important to remember that the structure of the EUDR focuses on avoiding a negative outcome rather than achieving a positive one. This typically means companies will do just enough to avoid penalties rather than invest in initiatives that create positive impacts.

"As long as the EUDR focuses solely on avoiding negatives, rather than promoting positive environmental outcomes, we won't have the legal framework to build a truly regenerative and improving carbon management system."

How Polygons Map Cocoa Farms

- Satellite Imagery and GPS Mapping:

- High-resolution satellite imagery and GPS devices are used to trace the exact boundaries of cocoa farms. The boundaries are marked as polygons on a digital map.

- Each polygon represents a specific farm, including its size, shape, and geographical location.

- Data Collection:

- In addition to spatial data, field teams collect other farm-level data such as ownership details, farming practices, and crop yields.

- This information is integrated into the farm's digital profile.

- Geospatial Analysis:

- The mapped polygons are analyzed using Geographic Information Systems (GIS) to understand farm-level and regional trends.

- For example, proximity to protected areas, deforestation risk, or overlaps with previously unmapped farms can be detected.

- Integration with Supply Chain Systems:

- The mapped polygons are linked with supply chain data to track cocoa beans from farms to processing facilities, ensuring traceability.

- Certifications, compliance reports, and audits can be tied to specific farms using their polygon identifiers.

Without a doubt, the use of polygons to map cocoa farms is a transformative step toward creating a transparent, fair, and sustainable cocoa supply chain.

But is the very system adopted to help create transparency open itself to abuse?

'Displaced' polygons

A source from one of the leading satellite mapping companies who wished to remain anonymous said he had yet to hear of a black market for polygons - but there had been evidence of polygons being 'displaced' to avoid deforestation alerts.

"Of course, the benefit of using satellite data is the ability to cross-control deforestation data with several providers and see the ground truth of the actual farm and plot information. Additionally, two farms can't be counted twice, but ultimately, it's the EU's job to control and enforce the regulation," he said.

Dan Rushton, content marketing manager at Picterra, a geospatial AI solutions provider, said: "While we have not specifically encountered a 'black market for farm polygons,' we are aware of concerns surrounding the manipulation of deforestation-free polygons for regulatory purposes. Picterra strongly opposes any practices that undermine the intent of the EUDR, which is designed to promote sustainability and accountability.

"Through our platform, we ensure that polygons representing agricultural plots are cross-verified using multiple satellite data sources. This allows us to monitor the actual state of the land and detect any inconsistencies, such as polygons being displaced, to avoid deforestation alerts. Furthermore, our process ensures that duplicate farms are not counted twice, preserving the integrity of the data we provide.

"Ultimately, while it is the responsibility of the EU to enforce the regulations, we stand ready to support these efforts with our robust verification capabilities. Such actions that attempt to sidestep the EUDR's goals only harm the larger mission of protecting the environment."

Van Heeden concluded: "The current focus on deforestation has centered around defining risk categories and what constitutes deforestation, but little to no effort has been directed toward reforestation or creating forest-friendly, biodiverse carbon capture programmes."

Market report

The price of cocoa futures is back on an upward curve, which could affect consumers' spending on holiday chocolates over the festive season.

Reuters also reports that cocoa firms are 'pouring' money into Ghana, with billions of dollars of upfront payments to the state marketing board Cocobod, in a bid to secure supplies and avoid another season of heavy losses.

In the past, Cocobod secured bank loans to buy farmers' cocoa and then sold the contracts for the crop forward to international companies. This year, for the first time in over twenty years, it decided not to secure syndicated financing to purchase this season's crop but instead used the companies themselves.

As the Reuters report pointed out: "Cocobod says bypassing the banks will slash costs. But the shift also marks a new era of risk for private players, the cocoa sector in Ghana, and the global chocolate industry."

- Read the full story here.