When CocoaRadar asked the EC recently who will bear the cost for implementing polygon mapping at the farm level, it responded by saying the “actual burden on producers is very small and geolocation information can be obtained through widespread, accessible technology and only needs to be established once (one-off cost).”

Many operators rely on open platforms like Global Forest Watch (GFW), which incorporates open data sets from GLAD, Hansen, and RADD to access near real-time information about where and how forests are changing around the world. However, many experts argue that GFW alone should not be used for EUDR compliance or business-sensitive assessments.

GFW is invaluable for broad environmental monitoring, and similar platforms offer an open data foundation for more sophisticated polygon datasets to be layered on that will comply with the EUDR.

It is a highly complex and specialised area. After all, if you are an operator or producer exporting a commodity to the European Union, you don’t want the consignment rejected because of a poor due diligence statement with incomplete farm geolocation that leaves open the question of the exact provenance of the goods.

An article on LinkedIn by Picterra said, “Open data solutions have become increasingly popular due to their efficacy and the trustworthy nature of the data, which often comes from well-respected institutions.

“Additionally, the improvements in available Earth observation sensors, from Landsat (30m) to Sentinel (10m), have been incorporated and have significantly boosted the precision of these data sets.

“Contrary to claims that these solutions are inherently unsafe, they can be highly reliable if integrated with robust methodologies and expert analysis.”

According to Picterra, “The key lies in how these data sets are utilized and interpreted.”

So, who is your solution provider, or are you still looking to hire a company?

We have unearthed some of the best high-tech satellite solution providers working with clients on EUDR compliance. The following list is in no particular order and with no preference; it is merely a guide.

The small start-up was established by geospatial data scientist Caroline Busse and offers deforestation-free sourcing and EUDR compliance. The company’s advanced satellite-powered technology with AI enables businesses to ensure traceability and track deforestation in their global supply chains.

The company’s AI-powered geospatial solutions are some of the most robust on the market, ensuring data integrity. Its GeoAI has been used in newsrooms, including The New York Times, for data-driven investigative journalism. Its platform is a game-changer for identifying and mitigating deforestation risks. It offers continuous mapping and monitoring of supply chain sourcing locations, ensuring diligent verification of deforestation risks in the supply chain.

Founded in 2011, Sourcemap is perhaps one of the more widely known supply chain transparency companies. It works in a multitude of commodities, including cocoa, coffee, and palm oil. Apart from mapping deforestation, it works with clients on child labour issues, traceability, sustainability, and supply chain mapping. In terms of EUDR, it offers a complete EU Deforestation Regulation solution, including ERP integration, geo-data collection, deforestation-free verification, shipment traceability, and automated submission to the EU customs portal.

A turnkey solution to solve EUDR for coffee and cocoa importers and producers. It was established by Salla Mankinen, a software architect and technologist with 20 years of experience building software for corporates, startups, and NGOs. The company offers producers a lightweight and offline-capable app for GPS positioning the farms and gathering required data on the ground, suitable for remote locations and challenging conditions.

Another big player and the market leader in using remote sensing technology for sustainable commodity supply chain risk management. Its EUDR solution offers to bridge the gap for smallholders with affordable access and effective distribution by connecting traders, processors, brands, and smallholders. It also collaborates with clients, NGOs, and institutes to ensure industry-wide efficiency.

Established in 2013, Koltiva is a leading agritech company that helps enterprises make their global supply chains traceable, inclusive, and climate-smart. It is backed by its own human-centered technology with boots-on-the-ground professional service. Its EUDR-focused solutions include geo-location for deforestation-free supply chains and legal compliance data features.

Aya Data offers geospatial and algorithmic models deployed over the cloud to automate traditionally manual operations at scale and harness the power of AI to transform agriculture and forestry projects. Its solutions include enhancing EUDR compliance with Humans-in-the-Loop (HITL), which combines expert manual inspection with top satellite analytics for polygon accuracy.

TraceX is a next-generation digital agriculture platform that leverages Blockchain to connect multiple participants across the food and agri supply chain and help them securely exchange verifiable and auditable data. This leads to mutual trust, accountability, traceability, and transparency among the participating actors. From ensuring deforestation-free practices to conducting due diligence and generating comprehensive reports, it empowers business to navigate EUDR regulations effortlessly.

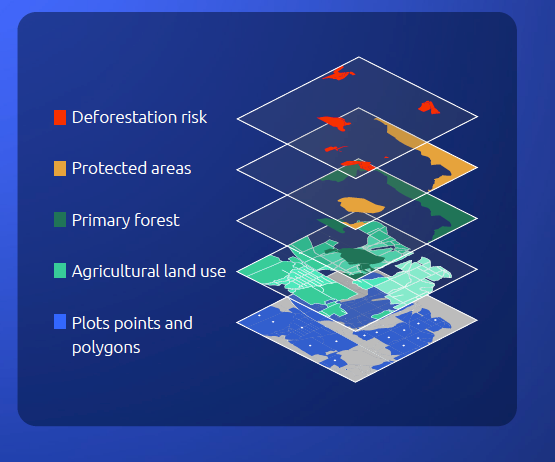

Agritask is a crop supply intelligence company providing visibility into the predictability and sustainability of crop supply for Food & Beverage enterprises. Earlier this year, it launched its Risk Assessment Engine for EUDR Compliance Solution designed for large-scale food and beverage operations to map supply chains and collect and analyse plot data in line with the EUDR. Companies can map the exact polygons of farms through various methods such as direct spreadsheet upload, digital map drawing, or AI plot mapping through a mobile app.

Farmforce customers span 32 countries across Africa, Asia, Europe, and South America. With over nine years of experience, it manages over 1 million farmers in 27 crop value chains in 15 languages on our platform. It offers an EUDR solution using its own Integrated Enterprise Deforestation Monitoring (IEDM) platform, comprising data acquisition and quality assurance through integrated on-ground assessment tools via the Farmforce Origin and Orbit apps.

Have we missed a solution provider? Drop us an email - let us know, and we will add them to our list.

(Disclosure: The author is a media strategist with African Cocoa Marketplace, which partners with Orijin and Aya Data.)

For more on polygon mapping, Aya Data is organising a free webinar on Wednesday, 14 August , 2024, 12:00 PM (CET): Algorithm v Human: Manual Satellite Data Analysis for EUDR Compliance, moderated by Anthony Myers. Sign up to watch live or on-demand - details are here.

Also published on CocoaRadar this week

In case you missed it, we covered the following stories ....