Editor’s picks: Hersey and Mondelēz report second-quarter drop in sales, cocoa futures rally; Rainforest Alliance publishes first audited EUDR certification holders.

Second quarter results

The Hershey Company (NYSE: HSY) announced net sales and earnings for the second quarter ended 30 June 2024, and updated its 2024 net sales and earnings outlook.

The US confectionery giant - with an estimated market capitalization of $38.83 billion - slashed its yearly profit and sales guidance after reporting a 17% drop in second-quarter sales.

As with many of the multi-nationals (and independent chocolate manufacturers), soaring cocoa prices have significantly impacted profits.

In a statement, Hershey CEO Michele Buck attributed the sales slowdown to “consumers pulling back on discretionary spending.”

Hershey’s CFO Steven Voskuil said in a call to media and analysts that the company expects the effects of high cocoa prices to “more than offset net price realisation and supply chain productivity,” leading to lower profit margins.

Futures contracts linked to cocoa skyrocketed earlier this year to an all-time high, and cocoa is more than three times as expensive than it was three years ago, Forbes magazine reported, due mainly to poor weather and crop conditions in western and central Africa, which produce most of the world’s cocoa.

Buck said: “Our business has been impacted by these trends, but we are pleased to see continued growth in the confection category and momentum building in our Salty Snacks portfolio. Our second-half innovation is expected to bring energy to our categories, and we are confident our evolving strategies will meet consumers' changing needs and drive long-term success."

Mondelēz International, Inc. (Nasdaq: MDLZ) also reported its second quarter 2024 recently.

The Cadbury/Oreo maker missed expectations for second-quarter revenue, citing budget-conscious customers who are opting for lower-priced private brands amid inflation concerns.

The company posted net revenue of $8.34 billion for the quarter ended June 30, compared with analysts' average estimate of $8.45 billion.

Net earnings for the quarter were also challenging, at $601 million, down 36% year-on-year, due to ongoing challenges of increases in cocoa prices, as well as with sugar and other chocolate ingredients.

“We continued to execute against our strategic growth agenda in the second quarter with strong profitability and attractive cash flow generation. Our performance was fuelled by our commitment to reinvesting in our brands, capabilities, ongoing price execution, and cost discipline,” said Dirk Van de Put, Chair and Chief Executive Officer.

“We are well positioned for the second half of the year with the completion of European pricing, the addition of new value offerings in the US, and a significant distribution runway across key emerging markets. Our teams remain focused on delivering our long-term growth agenda while remaining agile in this dynamic operating environment.”

The Chicago, Illinois-based company also maintained its annual organic net revenue and profit forecasts.

Marketwatch

ICE cocoa futures rallied on Wednesday (7 August 2024) as investors remained concerned about supply tightness. A Reuters poll of 12 traders and analysts showed that analysts expect a continuous upswing in cocoa prices this year due to persistent supply shortages that will leave them at more than double last year's levels by the end of 2024.

December London cocoa rose 3.2% to 5,600 pounds a metric ton yesterday.

December New York cocoa rose 4.2% to $7,054 a ton.

In a note on Nasdaq, dealers noted rising premiums for September versus December contracts in both London (LCC-1=R) and New York (CC-1=R), indicating tight near-term supplies.

Refinitiv analyst Marcin Gorski told Reuters warm and dry conditions will prevail across the West African cocoa regions over the next 10 days, adding they may suffer from inadequate moisture if not enough late rains arrive in September.

According to barchart.com, another bearish factor for cocoa is an improving outlook for the next cocoa season in West Africa. The end of the El Nino weather pattern and a potential shift to a La Nina pattern are set to boost precipitation in Cote d'Ivoire and Ghana, boosting soil moisture levels and increasing cocoa yields.

The website reported an increase in cocoa exports from Nigeria, the world's fifth largest cocoa producer, is negative for prices.

Nigeria's June cocoa exports rose +18% y/y to 14.465 MT, according to a report by Bloomberg on Monday.

A bearish factor for cocoa prices was the projection from Ghana's cocoa regulator on 13 June that Ghana's 2024-25 cocoa production will rebound to 700,000 MT from 425,000 MT in 2023-24 as improved weather conditions boost cocoa yields. Ghana's 2024/25 cocoa harvest begins in October.

Trader Ecom Agroindustrial projects Cote d'Ivoire cocoa production in the 2023-24 marketing year, which ends in September, will fall -21.5% y/y to an 8-year low of 1.75 MMT.

Cocoa grindings

Cocoa prices have been supported by better-than-expected cocoa demand. On 18 July the National Confectioners Association reported North America Q2 cocoa grindings rose +2.2% y/y to 104,781 MT, stronger than estimates for a slight decline.

The Cocoa Association of Asia reported that Asian Q2 cocoa grindings fell -1.4% y/y to 210,958 MT, a smaller decline than expectations of -2.0% y/y.

The European Cocoa Association reported on 11 July that Q2 European cocoa grindings unexpectedly rose +4.1% y/y to 357,502 MT, versus expectations of a -2% y/y decline.

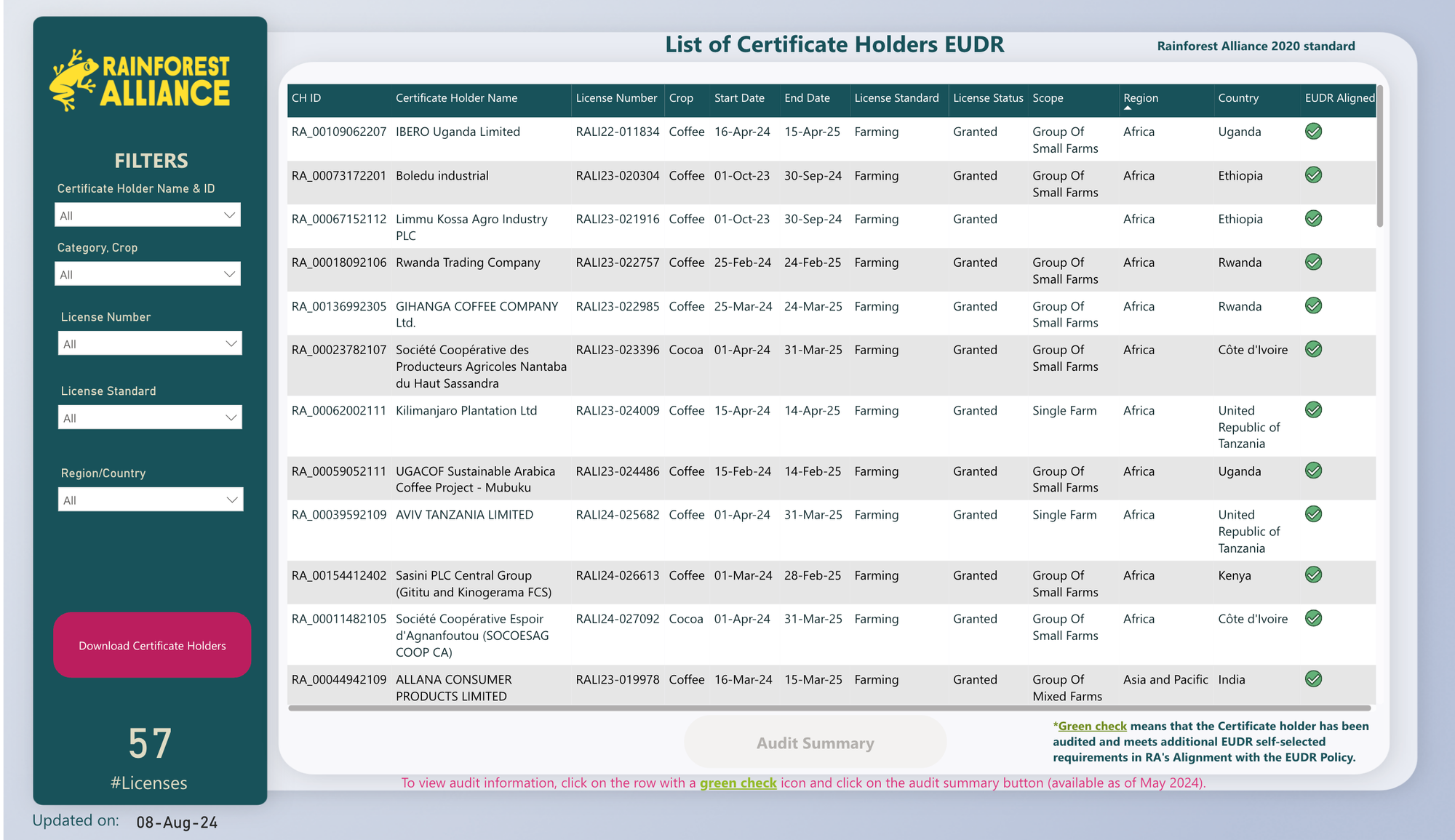

Rainforest Alliance EUDR certification holders

The Rainforest Alliance certification is one of the standards set for sustainable procurement in the cocoa sector - and other commodities.

As the industry is fully aware, certifications alone cannot prove compliance with the EUDR but can be used to support the data collection process

Therefore, the Rainforest Alliance and other certification bodies have a slight advantage in setting up systems to support producers and supply chain actors in meeting the requirements of the EUDR.

In addition, the organisation says its standard requirements already align with the EUDR, and four self-selected requirements have been introduced to cover aspects of the EUDR that were not fully aligned.

“These requirements are only applicable to cocoa and coffee Farm Certificate Holders. Certified farms can choose to implement these additional requirements and have these covered in their audits to support actors further down their supply chains to comply with the EUDR and continue selling their products on the EU market,” it said.

Rainforest Alliance has published its first tranche of certificate holders that have been audited and meet additional EUDR self-selected requirements in the Rainforest Alliance’s Alignment with the EUDR Policy.

Click on the chart for more details.