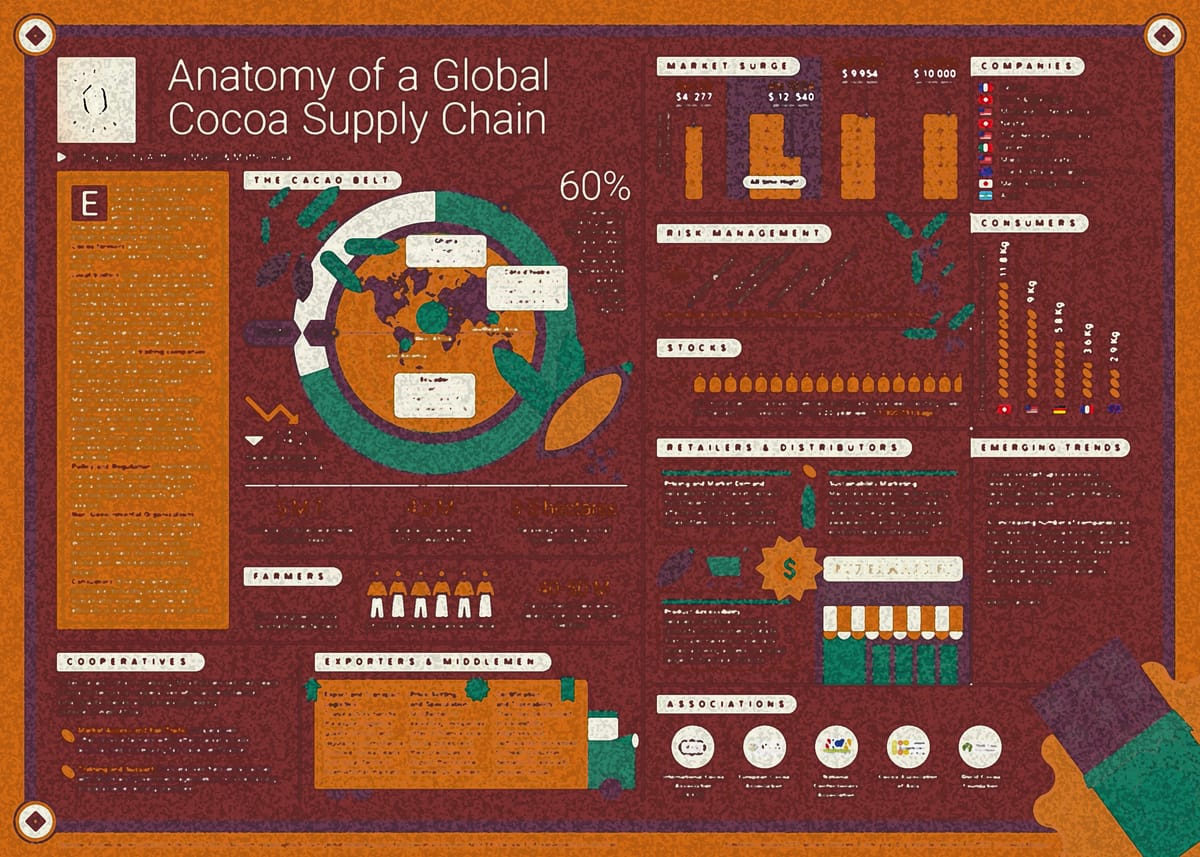

The problem for US chocolate makers is that they typically import raw cocoa from West Africa (Cote d’Ivoire, Ghana), Latin America, and Southeast Asia. These countries may be subject to general import tariffs unless exempted by special arrangements.

It’s a concern because tariffed cocoa imports would immediately raise input costs for chocolate manufacturers. Sugar from countries including Mexico and Canada may be targeted depending on trade agreements. Dairy imports (e.g., milk powder from the EU or New Zealand) could also face new tariffs.

While big players like Hershey can use their clout to 'use every lever at their disposal to get the tariffs changed', Gary Guittard, chief executive of Guittard Chocolate Co, said that after absorbing the impact of a 180% spike in cocoa prices last year, he was now contemplating adding another 10% to the company’s input costs.

The family-run San Franciso-based company was established in 1868. It employs approximately 240 people and is a pioneer in premium, sustainable chocolate and other cocoa products.

In a recent interview with the Los Angeles Times, Guittard said he is determining how much the company can absorb before passing the increase on to clients.

“We certainly can’t absorb it all. We’re a small family company, not a large multinational conglomerate,” he said.

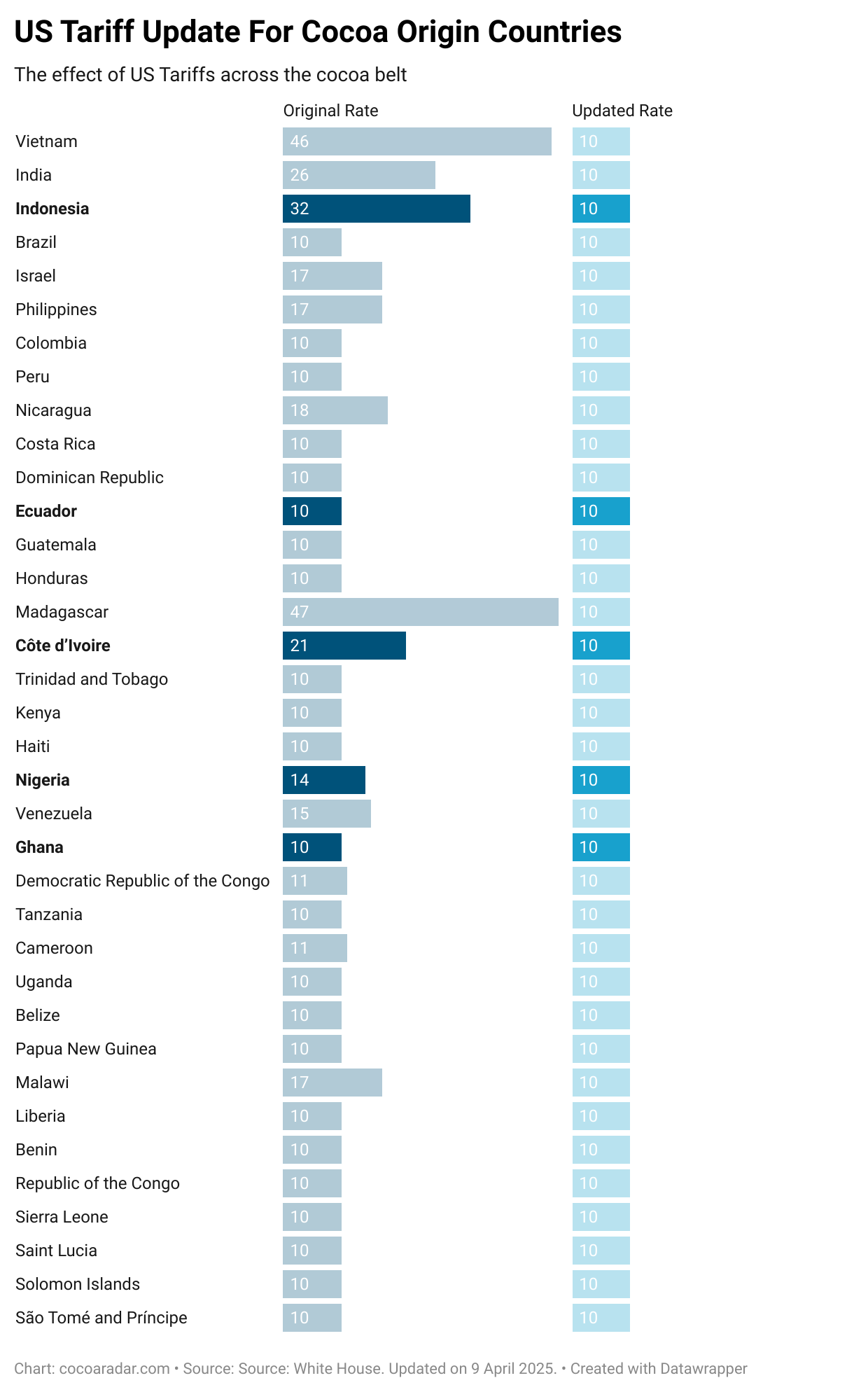

As CocoaRadar recently reported, higher tariffs were imposed on cocoa-producing nations from which Guittard and other manufacturers purchase their beans (see chart).

Complicated picture

Guittard told the LA Times that the picture becomes increasingly complicated when US manufacturers try to determine prices for a particular product that uses bean blends with different tariffs.

For instance, the company’s inventory currently includes pre-tariffed beans and is expecting tariffed shipments from South America.

“There’s 10 different ways to look at it. So we’re just trying to figure out the best way for us and our customers,” said Guittard.

As manufacturers absorb higher costs, price increases on retail chocolate and confectionery products are highly likely, particularly for premium brands and imported lines.

Even assuming private-label and mass-market brands may be less impacted initially, cost pressures will ripple through the supply chain.

To offset tariffs, US chocolate companies should explore sourcing from high-tariff nations to “friendly” countries or domestic suppliers to increase local cocoa processing (e.g., buying semi-processed cocoa liquor or butter from US-based facilities).

Companies should also accelerate investment in vertical integration to secure supply chains.

More economic turbulence

Generally, US businesses and consumers are bracing for continued economic turbulence as the administration’s trade policies evolve.

According to a report by Business Insider, economists warn that the tariffs, combined with proposed tax cuts, could exacerbate the US national debt, potentially leading to a debt-to-GDP ratio exceeding 180% within 30 years.

“Additionally, the average American household may see a reduction in purchasing power by approximately $2,800 in 2024 dollars.”