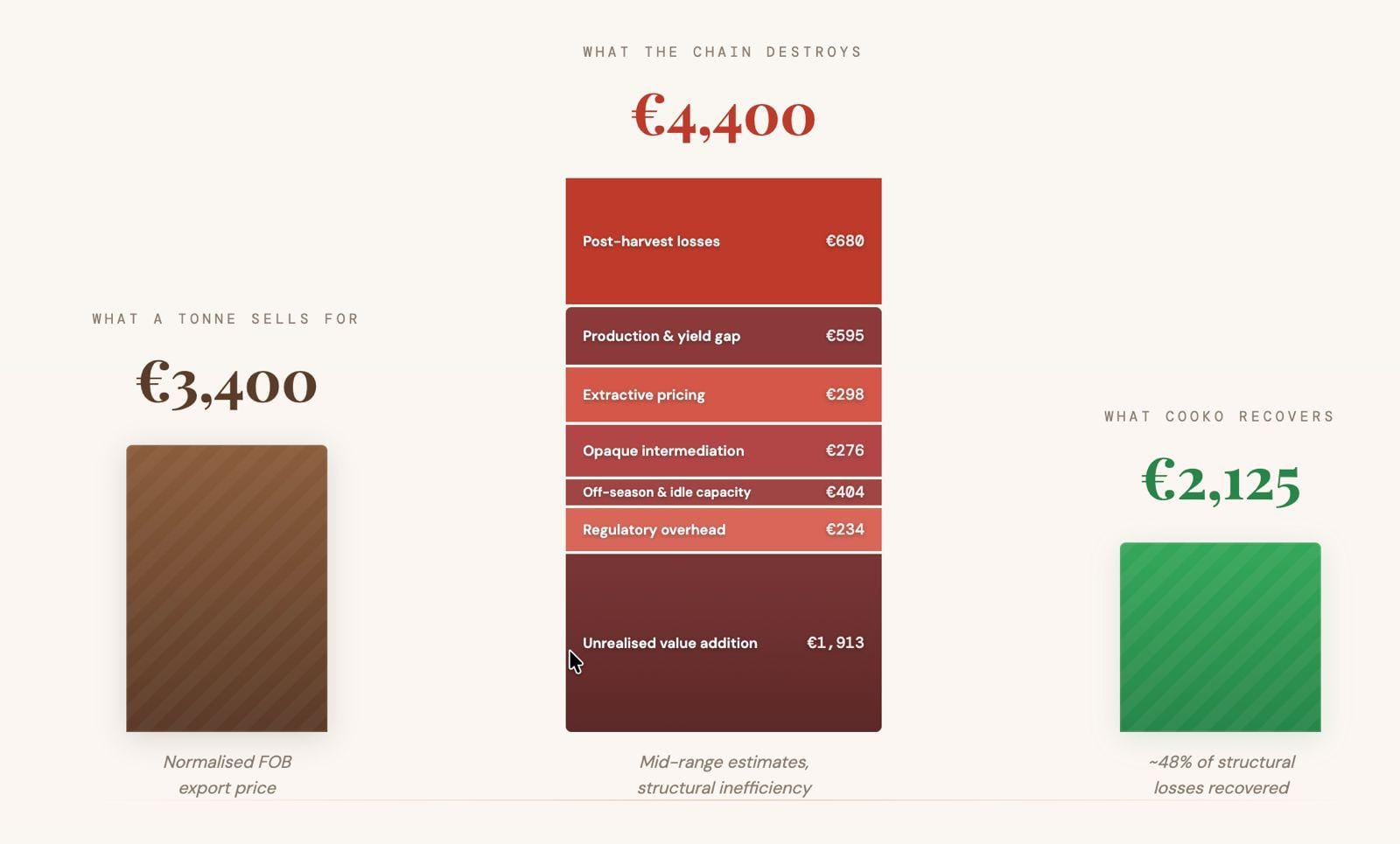

Here is an uncomfortable number for your Tuesday morning: for every tonne of cocoa that leaves West Africa, an estimated €4,400 in value is destroyed, extracted, or left on the table by a supply chain that has barely changed in decades. That is more than the bean itself is worth at current FOB prices.

Not all of that is recoverable. But a significant portion of it, perhaps half, is being lost to failures that are structural, not inevitable. Poor fermentation. Opaque intermediaries. Seasonal operations that leave factories idle and pods rotting on trees for months at a time. A traceability gap that the EUDR is about to make obvious.

These are not new complaints. What is new is that we are not accepting it as inevitable and built an operational model that demonstrates what the value chain looks like when you actually fix the plumbing.

Beurs van Berlage, Amsterdam, NH

Tuesday, Feb 17 from 10 am to 12 pm CET

The Six Leaks

Analysis prepared for the workshop identifies six interconnected structural inefficiencies, each quantified in cost per tonne:

Production fragmentation and the yield gap (€425–€808/tonne). West African farmers average 400–500 kg per hectare, roughly half the achievable yield, under improved practices. The per-tonne cost of production is effectively doubled by this gap. Ageing tree stock, near-zero access to credit, and absent extension services lock farmers into a low-input, low-output cycle.

Opaque market intermediation (€170–€383/tonne). Between the farmgate and the export warehouse, cocoa passes through pisteurs, coxeurs, and licensed buying companies. Each layer takes a margin, introduces information asymmetry, and fragments quality signals. The farmer rarely sees a quality premium, even when one exists downstream.

Post-harvest quality and physical losses (€425–€935/tonne). This is the big one. Rudimentary heap fermentation, weather-dependent drying, inadequate storage; studies estimate 20–30% of potential value is lost before beans reach the port. The flavour potential of West African origins is systematically squandered by processes that have not changed despite great intentions.

Extractive pricing mechanisms (€170–€425/tonne). The Living Income Differential was meant to transfer $400 per tonne to farmers. Evidence suggests it has been partially offset by reductions in country differentials and origin premiums. Meanwhile, informal deductions at the point of purchase, delayed payments, and asymmetric hedging capacity continue to suppress the farmer's effective share.

Regulatory and institutional overhead (€128–€340/tonne). Marketing board bureaucracy, opaque fiscal management, and the incoming EUDR compliance burden, which will disproportionately hit origin-country actors who lack digital traceability infrastructure. For non-prepared supply chains, compliance costs alone could add €50–150 per tonne.

Value addition deficit (€1,275–€2,550/tonne). West Africa still exports 65–75% of its cocoa as raw beans. The highest-value transformation happens in Europe. This is the largest single category of stranded value — and arguably the hardest to unlock at scale.

The ‘Reality Cheque’ Proposition

Next Tuesday morning (17 Feb) at the Beurs van Berlage, three speakers with very different perspectives will stress-test these numbers before an audience of chocolate makers, traders, and sustainability officers.

Dr Kristy Leissle, founder of the African Cocoa Marketplace and one of the sharpest academic voices on West African cocoa economics, will bring the macro lens. Her work on market access, trade dynamics, and the structural barriers to origin-country value capture puts the per-tonne numbers into political and historical context.

Sylvestre Awono brings the perspective of Puratos' Cacao-Trace programme — one of the most scaled sustainable sourcing operations in the industry, with deep experience in post-harvest centre implementation and community-level investment. He knows what works at volume, and what falls apart.

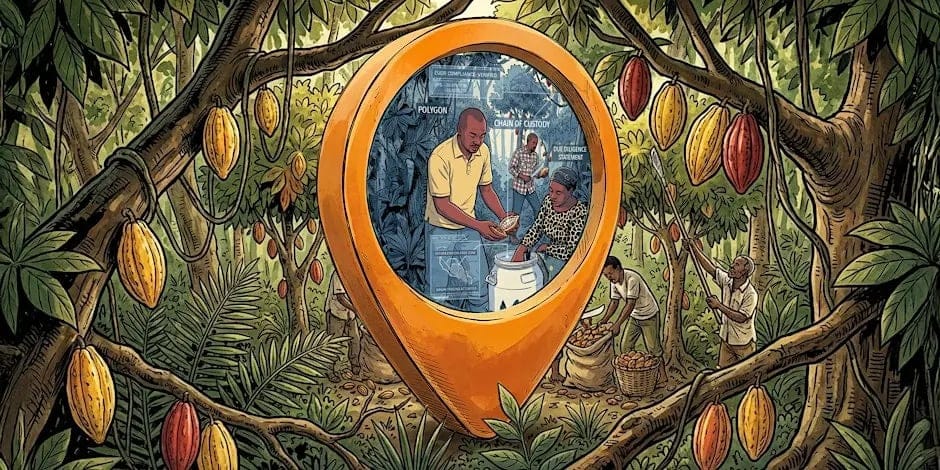

Ferdi van Heerden, CEO of COOKO, will present the operational counter-model. COOKO's fermentation facility in Cameroon runs twelve months a year — not six — with controlled anaerobic and aerobic fermentation, greenhouse drying, and end-to-end digital traceability from GPS-mapped farm plots through to the buyer's receipt. The SOP eliminates the intermediary chain entirely: farmers are paid via mobile money within days, at a transparent weekly price, with digital receipts for every transaction.

The claim is provocative: that this model recovers roughly €1,200–€3,100 per tonne of the system's structural losses. The year-round operation alone unlocks an estimated €130–€340 per tonne in value that the conventional seasonal model simply leaves on the tree.

Why This Matters Right Now

The timing is not accidental. The cocoa market has spent two years in crisis — prices that touched €11,000, demand destruction across Europe and Asia, and a supply chain that proved far more fragile than anyone on the buying side had assumed. Prices have since retreated to around €3,400, but JP Morgan's structural forecast of approximately €5,100 per tonne suggests the era of cheap West African cocoa is over.

Meanwhile, EUDR compliance deadlines are approaching. Large operators face a December 2026 deadline to demonstrate farm-level traceability and deforestation-free sourcing for every shipment entering the EU. The industry's current approach — retrospective auditing, third-party certification, post-hoc verification — is expensive and, as the workshop organisers argue, structurally backwards. You cannot audit quality and traceability into a supply chain that was not designed to produce either.

The workshop's central provocation is that the industry has been writing cheques to consultants and certifiers when it should have been investing in first-mile infrastructure. The session title — ‘Reality Cheque’ — is a deliberate double meaning: a reality check on where sustainability budgets actually go, and a question about who is cashing the cheque.

The Format

This is not a panel of polite agreement. The two-hour session opens with three 10-minute provocations — the "hard truths" — followed by audience breakouts debating whether the current industry strategy for West Africa is fundamentally flawed, and closes with a call to action. Space is strictly limited to keep the discussion substantive.

If you are a chocolate maker, trader, or sustainability officer who suspects the current model is not delivering, this is the room to be in.

INDICATIVE REFERENCES

- ICCO. Cocoa Market Review and Fine Flavour Cocoa Reports.

- Sukha, D.A., Umaharan, P., & Butler, D.R. (2017). Evidence for applying the concept of terroir in cocoa flavour and quality attributes. International Symposium on Cocoa Research, Lima, Peru.

- Afoakwa, E.O. et al. (2014). Flavor formation and character in cocoa and chocolate. Food Chemistry.

- Kongor, J.E. et al. (2016). Factors influencing quality variation in cocoa fermentation. Journal of Agricultural and Food Chemistry.

- Sponsored content: This article was created in collaboration with COOKO. While it aligns with our audience’s interests, the ideas and content are provided by COOKO, which retains copyright and editorial responsibility. We’re sharing it to offer our readers relevant information and perspectives.

- Attending Chocoa 2026? Check out more workshops from COOKO: