CocoaRadar understands the latest development was reaffirmed overnight by Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent, following communication confusion after President Trump’s post on his social media platform, Truth Social.

The president claimed the US would start delivering tariff letters from noon ET (1600 GMT) on Monday.

It is now understood that the White House is sending formal notifications (“letters”) to approximately 100 countries, detailing the new tariff structure and urging them to reach trade agreements before 1 August.

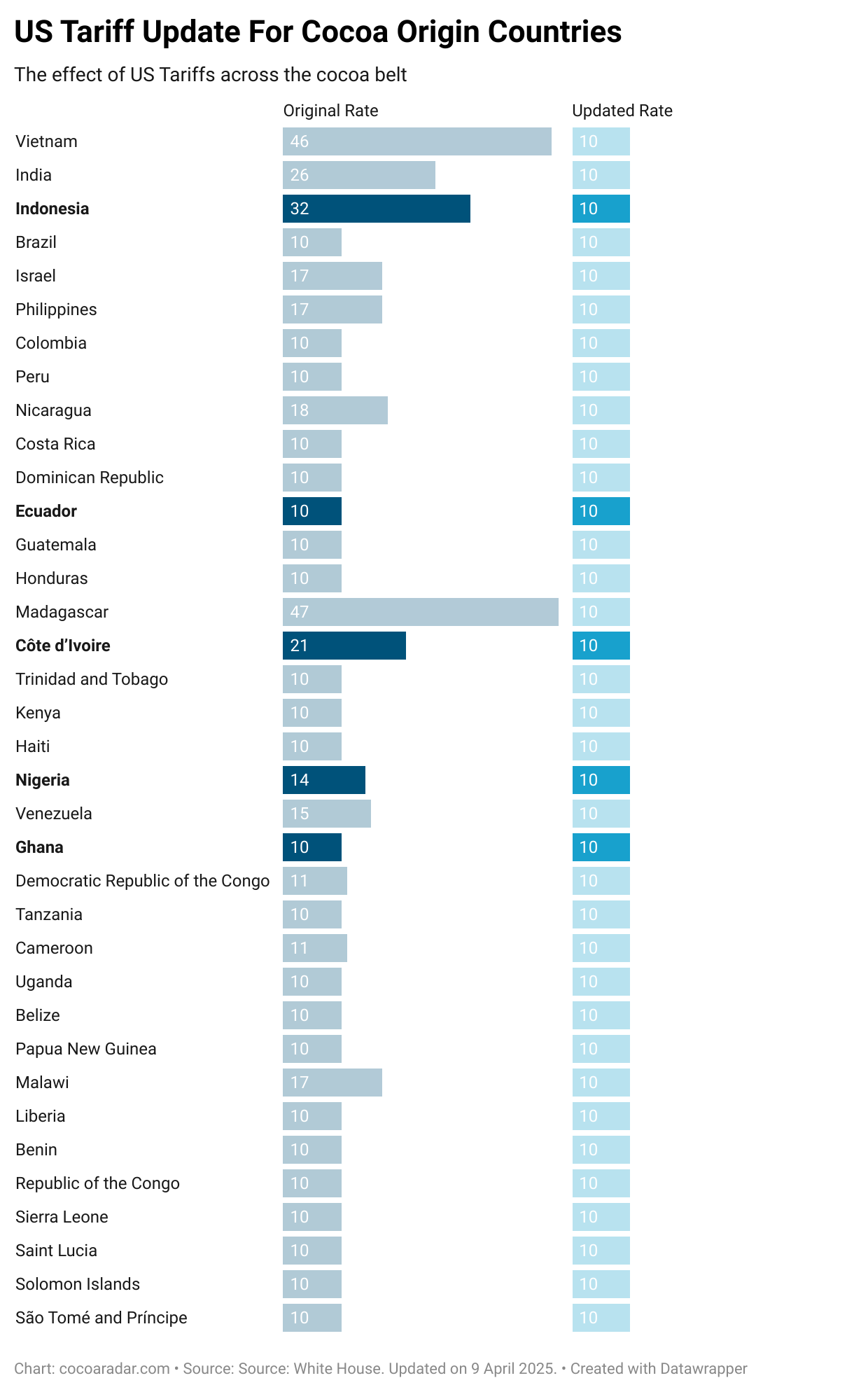

Scope & Rates

- A 10% base tariff applies to most imports, with a maximum rate of 70% on certain goods.

- An additional 10% surcharge is applied to countries aligned with the BRICS bloc (Brazil, Russia, India, China, South Africa).

Ongoing Negotiations

Mainstream media are reporting that European Commission president Ursula von der Leyen and Donald Trump had a “good exchange” on Sunday, raising hopes of an EU-US deal by Wednesday.

In a press briefing, Olof Gill, the EU trade spokesperson, told reporters, “We want to reach a deal with the US. We want to avoid tariffs. We believe they cause pain. We want to achieve win-win outcomes, not lose-lose outcomes”.

- India has laid down strict conditions regarding agriculture and dairy, but is nearing an interim deal.

- Japan is still in discussions.

- Deals with the UK and Vietnam are already in place, serving as models.

Market & Global Impact

- US stock futures dipped in reaction to the escalation of tariffs.

- The US dollar is at a critical juncture, influenced by delays and geopolitical uncertainty.

- China is already rerouting exports through Southeast Asia, prompting the U.S. to impose tariffs on goods re-exported from Vietnam (~40%).

What US Tariffs Could Mean for Cocoa

An ongoing and confusing situation

Stakeholders in the cocoa and chocolate industry should prepare for a period of heightened cost volatility, supply chain reshuffling, and regulatory uncertainty.

Here’s what we know so far—and what it could mean for the sector: Though raw cocoa beans are not currently targeted, chocolate products, cocoa derivatives, and ingredients sourced from BRICS nations could be affected, directly or via transhipment hubs like Vietnam.

Potential Impacts on the Cocoa & Chocolate Industry

Rising Costs for Chocolate Manufacturers

If processed cocoa ingredients (butter, powder, liquor) or chocolate imports face new duties, manufacturers may pass on costs to consumers, just as the industry grapples with record-high cocoa prices.

Supply Chain Rerouting

Expect strategic moves by US companies to:

- Source more from non-BRICS cocoa origins (e.g. Côte d’Ivoire, Ghana);

- Bypass re-export countries facing scrutiny;

- Explore more in-house US processing of raw beans to avoid import taxes.

Domestic Processing on the Rise?

A tariff on imports of cocoa butter or chocolate could boost investment in US-based grinding and processing, potentially reshaping how and where value is added in the cocoa chain.

Pressure on Global Players

Multinationals like Mondelez International, Barry Callebaut, and Nestlé operating in the US could face:

- Margin squeeze

- Regulatory complexity

- Risk to their U.S. growth strategy

Cocoa Demand Concerns

If US chocolate prices spike too sharply, we may see a softening of consumer demand, which would dampen grindings in key regions and pressure global prices.

Strategic Outlook

What Comes Next?

As negotiations with countries such as India, the EU, and Japan continue, and letters are sent to over 100 nations, the cocoa industry faces a complex summer of planning.

We’ll be watching:

- Which countries secure bilateral deals to avoid tariffs?

- Whether processed cocoa goods are added to the tariff list.

- How commodity traders and processors adapt to new cost and compliance realities.

Want deeper insights?

Become a Premium Subscriber for weekly market analysis, origin reports, and exclusive interviews with supply chain leaders.

More Coverage:

- From the Desk of CocoaRadar is the official media partner ECA 9th European Cocoa Forum.

- 'From Our Desk. To Yours. Daily.'